New Feature: Instant Payments via RTP and FedNow

Layer2 Financial or Zerohash:

which is the best for launching payments?

Both offer multi-partner platforms to provide customers with payments through API.

.png?width=2000&name=Layer2%20Financial%20or%20Zerohash%20for%20payments%20infrastructure%20(2).png)

In need of a payment API that includes digital asset onramp & offramp?

If integrating a fiat-to-crypto gateway is on your agenda, Layer2 Financial and Zero Hash are notable API gateways worth considering. Both services provide a streamlined process for users to convert their fiat into digital assets, while also offering business services to do the same.

This comparison will delve into the specifics of what Layer2 and Zero Hash bring to the table, scrutinizing their strengths and weaknesses to aid you in selecting the one that aligns with your flow of funds.

From API integration, there are many ways to ramp crypto. Let's learn how these two providers on & off ramp!

About Layer2 Financial

Layer 2 Financial is a platform that provides compliant payments by handling KYC, AML, and other transactions monitoring. Their API infrastructure provides the ability to launch collections, payouts, FX, and other finance use cases.

PROS

- Trusted brand (Market leader)

- Support in United States & Canada

- Simple widget & API

CONS

- CAD support coming soon

- No SDK codebases to use

- Large spread on price quotes

About Zero Hash

ZeroHash is a platform that provides infrastructure for asset movement and settlement. Their infrastructure powers various financial applications, allowing businesses to integrate and offer digital assets.

PROS

- Trusted brand (Market leader)

- Support in United States & Brasil

- API access

- Supports ACH through Plaid

CONS

- Primarily focuses on large brands

- No FBO accounts

- Lacks SDK codebases to use

- No Canadian support

How do Layer2 and Zerohash compare?

Let's look at key features and characteristics for these payment infrastructure providers.

How many countries do they operate in?

ZeroHash Holdings is Delaware registered and has several entities below it in its structure, like Zero Hash Australia, Zero Hash Brazil, Zero Hash UK, Zero Hash Worldwide, Zero Hash Europe.

Layer2 Financial Holdings is a Canadian entity, Layer2 US is a US entity, Layer 2 Financial UAB is a Lithuanian Private Company. All of these companies are apart of the Layer2 group.

What payment methods are supported?

Both Layer2 and Zero Hash offer ACH transfers in the United States, along with other methods of funding dependent on jurisdiction.

Do they have integration fees?

You will need to confirm integration fees with the vendors, as we are not aware of current fee structures.

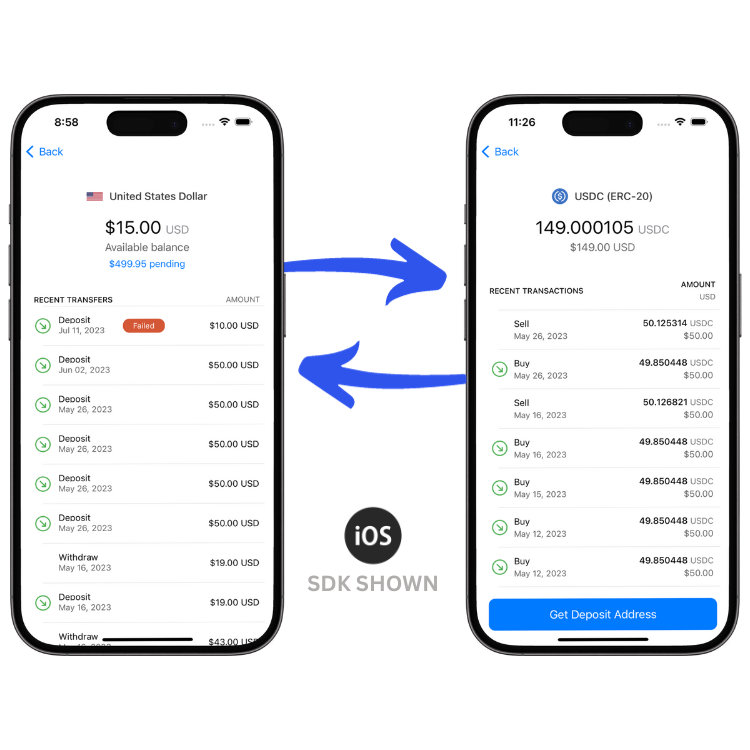

Do they offer APIs and SDKs?

Layer2 and Zerohash only have an API for developers to get started. This will require UI components and applications to be built on top of the basic API end points.

Where are their headquarters?

Layer2 is located in Toronto, Ontario.

Zerohash is located in Chicago, Illinois.

Which fiat to crypto provider is best for my business in the United States or Canada?

Choosing the ideal fiat onramp for your company requires careful consideration, as each service presents distinct advantages and potential drawbacks. What proves effective for one enterprise may not align with the needs of another.

Both Layer2 Financial and Zero Hash are renowned for their global partnerships with leading brands, although their services may not be universally adaptable for every market niche.

For those in pursuit of an uncomplicated widget, both Layer2 and Zero Hash facilitate straightforward installations and provide accessible API guides. On the other hand, for businesses seeking a more comprehensive payment system, particularly within the United States and Canada, Cybrid stands ready to deliver an all-encompassing solution.

Get the best North American onramp and offramp experience with a single integration

Cybrid gives you more than just a way to move money and ramp crypto. We’ve built a whole system that makes these money moves quick — like, our ACH API with that allows for instant and same-day transactions.

Looking for a payment setup that provides an end-to-end flow of funds? Cybrid's got your back. Give us a shout and we'll show you how we can make things better for you and the folks using your service, all while saving you some serious time and cost.