New Feature: Instant Payments via RTP and FedNow

Fintech as a Service

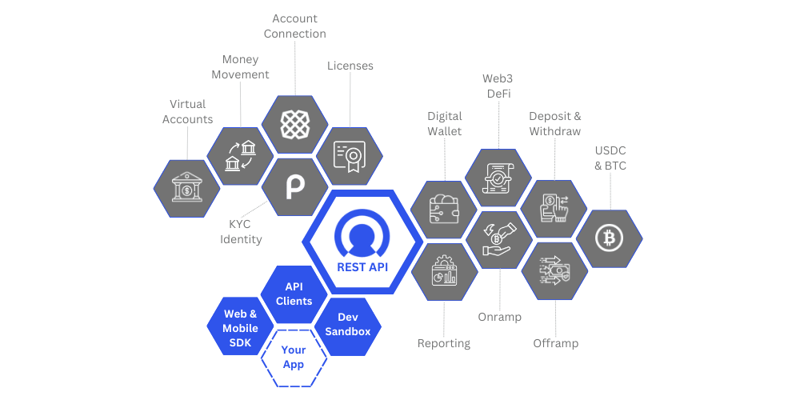

Our All-In-One Platform for Bank Account Connection, KYC Identity Onboarding, Multiple Payment Channels, Virtual Cash Accounts Management, and Robust Compliance & Fraud Protection - Redefining the Future of Fintech Services.

KYC Process

Optimize your customer onboarding with our KYC & Connect service, ensuring secure, seamless bank account connections, and stringent identification verification.

Money Transmission

Enjoy flexible, secure, and efficient money transmission with our multi-modal platform supporting ACH, RTP, Wire, and EFT.

.png?width=64&height=64&name=money-bag%20(1).png)

Virtual Cash Accounts

Leverage our FBO Virtual Cash Accounts, supporting USD and CAD, to provide your customers with enhanced financial control and seamless fund management for payments.

Crypto friendly payments can be difficult

Bank accounts, KYC identity, money transmission, and crypto liquidity is tough to bring together.

Cybrid is an end-to-end

Fintech as a Service Provider

Experience the future of financial integration with our platform, designed to streamline your operations and enhance your customers' experience.

Ready to redefine your fintech services? Join us and take the first step towards a seamless and secure financial future.

Account Connection

KYC Identity Onboarding

ACH, RTP, Wire, EFT

Virtual FBO Accounts (USD & CAD)

Regulatory Licenses & Reporting

Easily Embed Our

Fintech-as-a-Service Platform

Access BTC and USDC friendly fintech services through our platform.

We offer OpenAPI 3.0 APIs, SDK Clients and UI Components to bootstrap your development.

Why Cybrid

Choose Cybrid for your embedded fintech needs and experience a seamless blend of advanced technology, security, and financial expertise.

What types of payments can be made with the Cybrid's fintech platform?

How does Cybrid's embedded fintech service integrate with existing bank accounts?

What benefits does Cybrid's embedded finance offer compared to traditional banking services?

How does Cybrid's service ensure secure transactions and compliance with financial regulations?

How can Cybrid's Fintech as a Service platform facilitate new revenue lines for my business?

What role does the RTP network play in the Cybrid platform?

Can the Cybrid platform handle global payments?

Want to get started with our Fintech Solution?

Schedule time to meet with our team and to let's start to discuss your roadmap and expected flow of funds, as well as answer any questions you and your team have.