Stay Compliant with AML Standards—Protect Your Platform from Financial Crime

AML compliance ensures financial institutions detect and prevent money laundering through robust laws, software, and regulatory programs.

What is AML compliance?

AML compliance refers to the set of laws, regulations, and procedures designed to prevent individuals and entities from disguising illegally obtained funds as legitimate income. Standing for "Anti-Money Laundering," AML measures are critical in the financial and banking sectors, especially within areas such as Embedded Finance where transactions are integrated into various services and platforms.

Seamless, Compliant Payments in Just 60 Days – Ready to Transform?

Experience the power of a cutting-edge payment orchestration platform. Book your free demo today!

Frequently Asked Questions

We've summarised the most frequently asked questions to help you get started with learning more about Cybrid.

Money laundering is the illegal process of making large amounts of money generated by a criminal activity, such as drug trafficking or terrorist funding, appear to be earned legitimately. It is a complex method used by criminals to disguise the origins of their funds, making it difficult for authorities to trace and prove the illegal source of the income.

With this information, you can understand the importance of ensuring robust AML compliance programs are in place at financial institutions and service providers.

An AML (Anti-Money Laundering) compliance program is a set of policies, procedures, and practices implemented by financial institutions and other regulated entities to comply with legal and regulatory requirements aimed at preventing, detecting, and reporting money laundering activities. The program is an essential component in the fight against financial crime and is a regulatory requirement in many jurisdictions.

An effective AML compliance program is tailored to the specific risk profile of the institution and is a critical aspect of its responsibility to prevent financial crimes. Regular updates and reviews of the program are necessary to adapt to changing regulatory landscapes and emerging risks.

In banking, AML (Anti-Money Laundering) compliance encompasses a comprehensive framework designed to prevent, detect, and report money laundering activities. This framework includes several key components:

-

Customer Identification and Verification (KYC)

-

Transaction Monitoring

-

Reporting Suspicious Activities

-

Risk Assessment

-

Record-keeping

-

Employee Training

BSA AML refers to the regulatory framework established under the Bank Secrecy Act (BSA) in conjunction with Anti-Money Laundering (AML) standards in the United States. This framework sets forth a range of requirements that financial institutions must adhere to for the purpose of detecting and preventing money laundering and other financial crimes.

Enacted in 1970, the BSA was one of the first laws in the U.S. to combat money laundering. It requires financial institutions to keep certain records and report certain transactions that might signify money laundering, tax evasion, or other criminal activities. These include reporting cash transactions over a certain threshold, typically $10,000.

AML (Anti-Money Laundering) software is a sophisticated technology used by financial institutions and various businesses to assist in compliance with AML regulations. This software plays a crucial role in preventing, detecting, and reporting money laundering activities. AML software encompasses various types of technology solutions, each addressing different aspects of the AML process:

Identity Verification Systems: These systems verify the identities of individuals or entities engaging in financial transactions. They are a critical part of the Know Your Customer (KYC) process and help in preventing identity theft and fraud.

Transaction Monitoring Systems: These systems continuously monitor financial transactions to detect suspicious activities. They use advanced algorithms to flag anomalies that might indicate money laundering, such as unusual transaction patterns or transactions involving high-risk countries.

Rules Engines: These are used to set specific parameters or rules that trigger alerts for potentially suspicious activities. Rules engines can be customized based on the type of transactions, customer profiles, and risk factors associated with different types of financial activities.

AML Compliance for Both Fiat and Digital Currencies: Modern AML software is equipped to handle both traditional fiat currencies and digital currencies, like cryptocurrencies. This is increasingly important as digital currencies become more prevalent and are used alongside traditional fiat currencies.

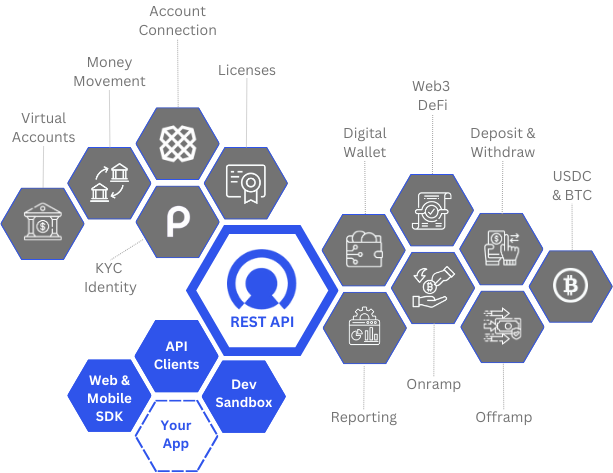

In the context of Embedded Finance, where financial services are integrated into non-financial platforms and applications, AML software becomes even more essential. Cybrid's Embedded Finance platform exemplifies this integration by bringing together multiple technology providers into a single platform. This integration allows developers to easily build and implement payment use cases that are compliant with AML regulations through available APIs and SDKs.

Cybrid offers a unified solution where developers can access a range of AML services, from identity verification to transaction monitoring, all within a single framework. This not only simplifies the development process but also ensures that applications built using Cybrid adhere to the necessary AML compliance standards set forth by our sponsor banks and other financial service vendors. By leveraging such a platform, businesses can efficiently incorporate compliant payment solutions into their offerings, catering to the evolving needs of the digital economy while maintaining regulatory compliance.

At Cybrid, we've harnessed the decades of payments and infrastructure experience that our team has accumulated to create the Cybrid platform. This experience includes incorporating the necessary pillars of BSA AML compliance:

Customer Identification and Verification (KYC): We have incorporated KYC and KYB processes to support B2C and B2B payment use cases. Easily embed KYC with UI SDK components and widgets.

Transaction Monitoring: All fiat and crypto transactions are monitored real-time for AML concerns, like OFAC sanctions screening. An advanced rules engine ensures that transaction monitoring and processing is fast and efficient.

Reporting Suspicious Activities: As a registered Money Service Business in both the United States and Canada, we file Suspicious Activity Reports (SAR) and other suspicious activity as set forth by the requirements of FINCEN and FINTRAC.

Record-keeping: We are an API focused company that utilizes modern, digital ledgering to ensure immutability and double-ledger accounting practices on all FBO virtual accounts that hold fiat and crypto funds.

Employee Training: The Cybrid team is dedicated to security and employee training, as such we have attained SOC 1 Type 1 level compliance, with a continued focus on improving our internal training and standards.

If you're interested in discussing utilizing Cybrid's Embedded Finance platform for your flow of funds and payments use case, let's book on the calendar below.

Trusted by Businesses Using Payments & Transfers Solutions

.png?width=200&name=Untitled%20design%20(18).png)

.png?width=200&name=Untitled%20design%20(17).png)

.png?width=200&name=Untitled%20design%20(16).png)

.png?width=200&name=Untitled%20design%20(15).png)

.png?width=200&name=Untitled%20design%20(13).png)

.png?width=200&name=Untitled%20design%20(12).png)

.png?width=200&name=Untitled%20design%20(9).png)

What Our Customers Say?

“Cybrid enabled us to reduce transaction processing time by 50%, improve operational efficiency by 40%, and achieve 3x growth within six months. Their seamless integration with our systems, robust compliance automation for KYC, KYB, and AML checks, and top-tier support allowed us to launch in production within twenty-two days."