What Is USDC? A Trusted Stablecoin Backed by the U.S. Dollar

USDC is a digital dollar token issued by Circle and backed 1:1 with U.S. dollars. It offers stability, transparency, and fast blockchain-based payments.

How USDC Works and Why It’s Essential in the Digital Economy

USDC runs on blockchain networks like Ethereum, Solana, and Polygon, and is widely used for payments, trading, remittances, and DeFi applications. As a fully reserved and regularly audited stablecoin, USDC ensures transparency and trust. It’s seamlessly integrated through developer-friendly APIs and SDKs, making it ideal for businesses and platforms looking to offer secure, stable digital transactions at scale.

Seamless, Compliant Payments in Just 60 Days – Ready to Transform?

Experience the power of a cutting-edge payment orchestration platform. Book your free demo today!

Frequently Asked Questions

We've summarised the most frequently asked questions to help you get started with learning more about Cybrid.

USD Coin (USDC) is a stablecoin, pegged to the US Dollar, meaning each USDC is equal to one US dollar in value. It operates on blockchain technology, offering secure and quick digital transactions. USDC is widely used for trading, payments, and as a stable store of value in the digital economy.

USD Coin (USDC) is a stablecoin, pegged to the US Dollar, meaning each USDC is equal to one US dollar in value. It operates on blockchain technology, offering secure and quick digital transactions. USDC is widely used for trading, payments, and as a stable store of value in the digital economy.

.png?width=100&height=100&name=Untitled%20design%20(8).png) USD Coin (USDC) is issued and managed solely by Circle Internet Financial. Circle, a prominent player in the financial technology sector, is responsible for maintaining the stability, compliance, and operations of USDC.

USD Coin (USDC) is issued and managed solely by Circle Internet Financial. Circle, a prominent player in the financial technology sector, is responsible for maintaining the stability, compliance, and operations of USDC.

Circle ensures that USDC is backed by sufficient reserves, primarily in U.S. dollars and potentially other assets like Treasury Bills, to maintain its peg to the US Dollar. This backing guarantees that each USDC token is equivalent to one dollar, providing reliability and trust in its value.

USD Coin (USDC) serves several purposes in the digital economy, making it a versatile and widely used cryptocurrency. Here are some of the primary uses of USDC:

-

Digital Transactions: USDC enables fast and secure transactions across borders without the typical fees and time constraints associated with traditional banking. This makes it ideal for many use cases including international business transactions, remittances, and everyday digital payments.

-

Trading on Cryptocurrency Exchanges: As a stablecoin, USDC is often used by traders on cryptocurrency exchanges to hedge against the volatility of other cryptocurrencies. Its stable value relative to the US Dollar makes it a safe haven asset in the volatile crypto market.

-

Smart Contracts and DApps Integration: Being an ERC20 token on Ethereum, USDC can be easily integrated into smart contracts and decentralized applications (DApps), enhancing its utility in various blockchain-based services and applications.

- A Stable Store of Value: People use USDC as a stable store of value, especially in regions experiencing currency instability or hyperinflation. Its 1:1 peg to the US Dollar ensures that it retains its value over time.

USDC is regulated as a form of stored value or prepaid access under the laws governing money transmission (or the statutory equivalent) in the various U.S. states and territories.

Transactions with USDC are executed on the blockchain, allowing for quick and secure transfers. This decentralized network ensures transparency and immutability of transactions. Users can send and receive USDC globally, use it for trading in various cryptocurrency exchanges, or as a stable currency for digital purchases.

The issuance of new USDC tokens is facilitated by Circle Mint, part of the Circle API, where US dollars are exchanged for an equivalent amount of USDC. Conversely, when USDC is redeemed, it's done through Circle Redeem, where USDC is exchanged back for US dollars. This process ensures the stability and reliability of USDC, making it a preferred choice for digital trading, payments, and as a stable digital currency in the financial sector.

The price of USDC is designed to be stable, typically pegged at 1:1 with the US Dollar. However, its value can vary slightly, especially in the context of Decentralized Finance (DeFi).

Circle's Redemption Policy: Circle, the issuer of USDC, maintains a strict 1:1 redemption policy. This means that for every USDC, Circle guarantees redemption for one US dollar. This policy ensures the stability and trustworthiness of USDC as a digital currency.

Price in DeFi Environments: Within the DeFi ecosystem, the price of USDC might slightly differ from the exact 1:1 peg. Some decentralized applications (dApps) hardcode USDC's value to $1.00 USD, while others rely on oracle pricing from various sources, such as liquidity pools. In liquidity pools, the price of USDC often stays close to $1.00 but may fluctuate slightly to account for transaction fees or market dynamics within the pool.

Cybrid's Approach: At Cybrid, we have a direct Circle account which allows us to redeem USDC directly with Circle. This direct redemption with Circle ensures that we adhere to the 1:1 peg for USDC, offering our clients and users a stable and reliable valuation in line with Circle’s policy.

In summary, while the USDC price is generally anchored to $1.00, slight variations can occur in decentralized environments, influenced by market mechanisms and oracle pricing. However, through direct redemption with Circle, Cybrid ensures adherence to the stable 1:1 USDC to USD valuation.

USD Coin (USDC) is considered to be one of the safer digital currencies, due to several key factors that contribute to its security and reliability:

Regulatory Compliance: USDC is issued by financial institutions operating within the US, ensuring compliance with the existing financial regulations. This compliance includes regular audits and adherence to specific standards in financial operations, which add layers of accountability and transparency to its management.

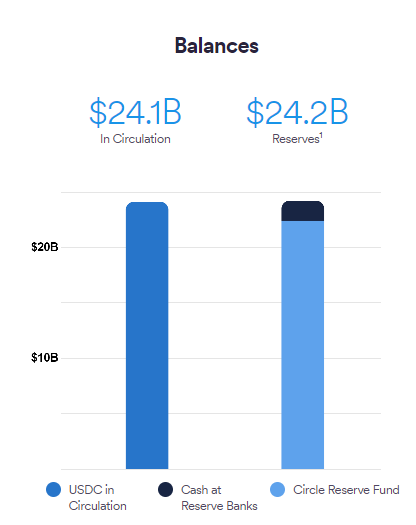

Asset Backing: USDC is a stablecoin, backed by equivalent assets held in reserve. These assets typically include cash and short-term U.S. Treasury securities. The reserves are audited regularly to ensure that they match or exceed the amount of USDC in circulation, providing a trustworthy 1:1 peg to the US Dollar.

Blockchain Security: Operating on blockchain technology, USDC transactions are secure, transparent, and immutable. Blockchain's decentralized nature makes it resistant to fraud and cyber-attacks, ensuring the integrity and traceability of transactions.

However, like any digital currency, it's essential for users to practice good security habits, such as using secure wallets, enabling two-factor authentication, and being cautious of phishing attempts and online scams. DeFi users should also be aware that the 1:1 peg can be affected, as seen with the 2023 USDC depeg event.

1. No Guarantee of Price Stability: Circle commits to a 1:1 tokenization and redemption rate for USDC against the U.S. Dollar, but there is no guarantee that USDC will maintain parity with the U.S. Dollar on all platforms, especially on third-party cryptocurrency exchanges.

2. Third-party Platforms: USDC is supported on various third-party platforms without Circle's direct endorsement or control, which means Circle is not responsible for any losses or issues encountered on these platforms.

3. Irreversible Transactions: Transactions involving USDC are irreversible. Once USDC is sent to an address, the risk of losing access to it due to incorrect addresses, lost private keys, or uncooperative address owners is borne by the user.

4. Blocked Addresses & Forfeited Funds: Circle may block addresses and freeze USDC associated with illegal activities or violations of the user agreement. Engaging with these addresses can lead to frozen funds and potential legal action.

5. Blacklisting: Circle has a policy to block the transfer of USDC to and from addresses in certain extraordinary circumstances, which can affect the usability and transferability of USDC.

6. Software Protocols and Operational Challenges: Users are exposed to risks from operational challenges such as cyber-attacks and technical difficulties, which may cause interruptions or delays in USDC services.

7. Compliance: Users are solely responsible for complying with applicable laws related to their use of USDC, including tax laws.

8. Legislative and Regulatory Changes: Changes in laws and regulations at various governmental levels may adversely affect the use, transfer, redemption, and value of USDC.

9. No Deposit Insurance: USDC is not protected by deposit insurance schemes like the FDIC or SIPC in the U.S., or their equivalents in other countries.

10. Claim on Funds: Redeeming USDC for U.S. Dollars is conditional on the possession of USDC, adherence to the user agreement, and the absence of legal actions restricting redemption.

11. Legal Treatment of USDC Transfers: The uncertain regulatory status of USDC and blockchain technology in various jurisdictions makes it difficult to predict how legal systems may treat USDC transfers.

12. Encumbrances: USDC transferred between addresses may become subject to liens or other security interests based on the actions of previous owners.

13. On-chain Transactions Irreversible: USDC transactions completed on the Ethereum blockchain are irreversible, and Circle cannot reverse these transactions once initiated.

For the most up to date risk disclosure, please visit Circle's Legal & Privacy page on the topic of USDC risk factors.

Yes, USDC (USD Coin) is backed by the United States Dollar (USD). It is a type of stablecoin, which means every USDC token is equivalent to one USD. The backing is maintained by holding an equivalent amount of USD in reserve, which ensures the value of USDC remains stable and tied closely to the value of the US dollar.

USDC is fully backed by an equivalent amount of U.S. Dollar-denominated assets held by Circle with U.S. regulated financial institutions in segregated accounts apart from Circle’s corporate funds, on behalf of, and for the benefit of, Users. This means that for every USDC issued by Circle and remaining in circulation, Circle will hold on behalf of Users either one U.S. Dollar (“USD”) or an equivalent amount of USD-denominated assets in its Segregated Accounts (the “USDC Reserves”).

The reserves held to back USDC are overseen by major financial institutions, ensuring transparency and compliance with financial regulations.

The mix of cash and U.S. Treasury securities provides a stable and secure backing for USDC. Regular attestations are conducted by independent accounting firms to verify that the value of the reserves matches or exceeds the number of USDC tokens in circulation. This process is crucial for maintaining the trust and stability of USDC as a digital currency. It assures users that their digital tokens can be redeemed for an equivalent amount of US dollars, providing a level of security and trust that is essential in the digital currency market.

The reserves backing USDC are held in regulated financial institutions, ensuring their safety and compliance with financial regulations. One of the notable institutions involved in managing these reserves is BlackRock, a leading global investment management corporation.

BlackRock, along with other financial entities, plays a crucial role in overseeing and safeguarding the assets that back USDC. These reserves primarily consist of cash and cash equivalents, and their management by reputable, regulated institutions like BlackRock adds an extra layer of security and trustworthiness to USDC.

Yes, USD Coin (USDC) operates on multiple blockchains, including Ethereum, and when issued on the Ethereum mainnet, it takes the form of an ERC20 token. The ERC20 standard is a widely-adopted protocol for Ethereum tokens, providing guidelines that ensure compatibility with the broader Ethereum ecosystem. This means that USDC on Ethereum can be easily integrated with various Ethereum-based applications, wallets, and smart contracts.

The multi-chain approach of USDC not only enhances its accessibility and usability across different blockchain networks but also allows it to leverage the specific advantages of each blockchain. You'll often find that Circle USDC's approach is to deploy where there are Layer 1 and Layer 2 financial applications that are Ethereum Virtual Machine (EVM) compatible. USDC is available on the following blockchains, click for each USDC token address:

For the latest list of blockchains, check Circle's listing on their developer page.

Bridged USDC is a form of USD Coin (USDC) that operates on layer two blockchains or sidechains, distinct from the standard USDC issued by Circle. It's created through open-source bridges which allow users to lock their Native Ethereum USDC in a smart contract and then mint an equivalent amount of Bridged USDC on a supported layer two network.

Circle, while being the issuer of the original USDC, does not issue or redeem Bridged USDC, nor does it back Bridged USDC with US dollars or any USDC-related reserves. The conversion of Bridged USDC back to Native Ethereum USDC depends on the availability of these layer two networks and bridges.

An example of bridged USDC is the Polygon PoS bridged Ethereum which was widely used prior to Circle launching native Polygon support.

Importantly, Circle does not own, control, or specifically endorse any of the supported layer two networks, bridges, or forms of Bridged USDC, highlighting the independent nature of this USDC variant.

Wrapped USDC refers to a variant of USD Coin (USDC) that has been adapted for specific use within a single blockchain network, often as part of a decentralized application (dApp). This process, known as 'wrapping', involves representing the original USDC with a different token form, such as cUSDC in Compound or aUSDC in Aave. These wrapped tokens signify ownership of USDC funds held by smart contracts within the dApp. Unlike bridging, which moves USDC across different blockchains, wrapping is confined to a single network and is integral to the functionality of various DeFi platforms. Wrapped USDC tokens enable users to engage with the unique features of these platforms.

Wrapped USDC tokens are not redeemable through Circle, and must be exchanged back to natively issued USDC token.

When comparing USDC and USDT, two of the most prominent stablecoins in the cryptocurrency market, key differences lie in their issuing companies and the composition of their reserves.

USDC, issued by Circle, is known for its transparency and regulatory compliance, particularly appealing to users and businesses seeking a stablecoin backed by straightforward assets. Circle, a U.S.-based company, primarily backs USDC with cash and cash equivalents. This focus on simpler, more liquid assets aligns with stricter U.S. regulations and offers a clear understanding of the reserve composition, which many users find reassuring.

USDT, issued by Tether, takes a more varied approach in backing its stablecoin. Tether uses a mix of assets to back USDT, including traditional currency, cash equivalents, other assets.

If you are interested in learning more about USDC vs USDT, make sure to read our blog post on the topic.

Acquiring USDC can be done through a variety of platforms, tailored to the needs of different users. For businesses and developers, Cybrid offers specialized services, while end-users are recommended to use one of the many partner platforms.

For Businesses and Developers - Onramping with Cybrid: Cybrid is ideally suited for businesses and developers looking to integrate digital currency into their operations. Through Cybrid's APIs and SDKs, businesses can convert traditional currencies (like USD and CAD) into USDC. This onramping service is developer-friendly, designed to facilitate a smooth integration of funds into the digital currency space.

For Businesses and Developers - Offramping with Cybrid: In addition to onramping, Cybrid provides offramping services for businesses. This allows for the conversion of USDC back into traditional currency (e.g., USDC to USD), which can then be withdrawn to a Plaid-connected bank account. This is particularly advantageous for businesses involved in payments and remittance.

For End-Users: Individual users looking to acquire USDC for personal use are recommended to transact through one of Cybrid’s partner platforms and/or a member of the Circle USDC ecosystem.

Cybrid stands out for its robust, secure, and developer-friendly platform, catering primarily to businesses and developers. Meanwhile, our partner platforms provide easy access for end-users, ensuring that everyone’s needs are met when it comes to engaging with USDC.

Trusted by Businesses Using Payments & Transfers Solutions

.png?width=200&name=Untitled%20design%20(18).png)

.png?width=200&name=Untitled%20design%20(17).png)

.png?width=200&name=Untitled%20design%20(16).png)

.png?width=200&name=Untitled%20design%20(15).png)

.png?width=200&name=Untitled%20design%20(13).png)

.png?width=200&name=Untitled%20design%20(12).png)

.png?width=200&name=Untitled%20design%20(9).png)

What Our Customers Say?

“Cybrid enabled us to reduce transaction processing time by 50%, improve operational efficiency by 40%, and achieve 3x growth within six months. Their seamless integration with our systems, robust compliance automation for KYC, KYB, and AML checks, and top-tier support allowed us to launch in production within twenty-two days."