Top Embedded Finance Use Cases for Payments & Crypto

Discover how leading companies are embedding financial services—from USDC and Bitcoin payments to B2B transfers and digital wallets—directly into their apps.

Explore Some of the Top Embedded Finance use Cases

Fiat <> Crypto trade liquidity, including popular cryptocurrencies like USDC .

Wallet infrastructure provides deposit and withdrawal capabilities for an all-in-one solution.

USD Coin, and others, are poised to disrupt the multi-billion dollar remittance industry.

Send and receive embedded payments in stablecoins for reduced costs and faster settlement.

Embrace the future of seamless Bitcoin payments with Cybrid.

Explore the disruptive multi-billion dollar remittance industry with reduced costs and settlement times.

Dive into the revolution of hassle-free remittances with Cybrid.

Discover a world of opportunities in the booming remittance sector, minimizing costs and speeding up transaction times.

USD Coin, and others, are poised to disrupt the multi-billion dollar remittance industry.

Send and receive embedded payments in stablecoins for reduced costs and faster settlement.

Step into the next generation of instant settlements with Cybrid's API platform.

Whether RTP or Instant ACH through reserve accounts, we're paving the way for faster, efficient, and secure financial transactions.

Seamless, Compliant Payments in Just 60 Days – Ready to Transform?

Experience the power of a cutting-edge payment orchestration platform. Book your free demo today!

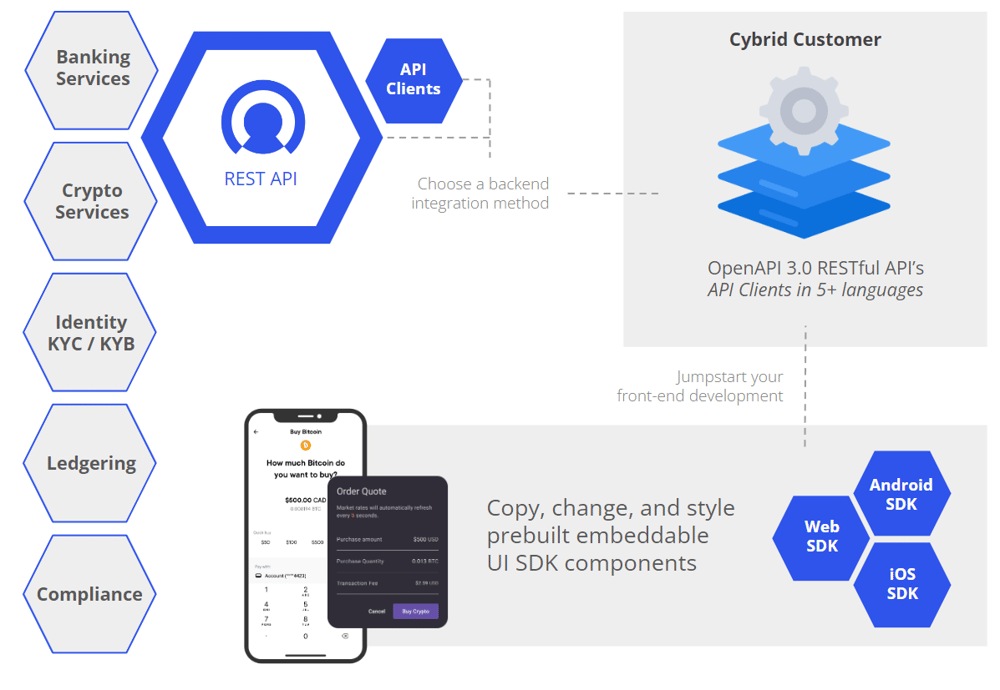

Are you searching for the best Embedded Finance Providers for Infrastructure as a Service (IaaS)?

The Cybrid platform offers a one stop shop; top choice as an Embedded Finance platform!

Frequently Asked Questions

We've summarised the most frequently asked questions to help you get started with learning more about Cybrid.

Imagine empowering your users to effortlessly send and receive money across international borders - right from their favorite messaging apps or social media platforms. This is the reality of embedding remittance services into your digital interfaces. But what makes this possible? Cybrid's Embedded Finance platform is the key.

Harnessing our advanced platform, we consolidate various payment rails to create a powerful, cohesive system for processing remittance payments. The result is a platform that not only streamlines remittances but also accelerates them, providing fast, efficient, and secure international transactions. By eliminating traditional barriers in cross-border transactions, we make it easier than ever for your users to manage their finances globally.

The embedded finance landscape has been revolutionized by integrated payment solutions, enabling users to complete transactions effortlessly within the same app. Notable payment-as-a-service providers such as Plaid [Plaid is integrated directly into the Cybrid platform] and Stripe have empowered businesses to incorporate embedded payment options, significantly enhancing user experience. As a result, McKinsey, Bain, and other organizations like FundThrough continue to signal and report on a significant shift towards more seamless transactions through embedded finance implementation.

For companies like Law Firms, explore how to streamline your payment process and accept cryptocurrencies with our tailored solution for invoices. Dive into the benefits of our Whitelabel Payments Portal, where you can accept Bitcoin and USDC seamlessly, all while maintaining your current treasury procedures.

Digital wallets are more than just a trend - they're the future of personal finance. By integrating a digital wallet into your platform, you offer users a seamless, efficient, and secure method of managing their money, all within an environment they're already familiar with.

But what does this integration look like? With Cybrid's Embedded Finance platform, it's straightforward and powerful. Our solution allows your users to store, send, and receive both fiat and cryptocurrency, enabling them to interact with their finances on their terms.

Integrating payment processing and lending options directly into online shopping experiences, streamlining the checkout process.

Integrating loyalty and rewards programs within existing apps, providing users with personalized offers and incentives based on their spending behavior.

3-Step Guide To Unlocking Embedded Finance

Learn how to seamlessly integrate embedded financial products and services.

Discover the secrets to transform your business today!

Trusted by Businesses Using Payments & Transfers Solutions

.png?width=200&name=Untitled%20design%20(18).png)

.png?width=200&name=Untitled%20design%20(17).png)

.png?width=200&name=Untitled%20design%20(16).png)

.png?width=200&name=Untitled%20design%20(15).png)

.png?width=200&name=Untitled%20design%20(13).png)

.png?width=200&name=Untitled%20design%20(12).png)

.png?width=200&name=Untitled%20design%20(9).png)

What Our Customers Say?

“Cybrid enabled us to reduce transaction processing time by 50%, improve operational efficiency by 40%, and achieve 3x growth within six months. Their seamless integration with our systems, robust compliance automation for KYC, KYB, and AML checks, and top-tier support allowed us to launch in production within twenty-two days."